-

unikadmin

- July 7, 2025

Access to capital can be a major problem for women entrepreneurs in India. Thankfully, several government-backed and private financial institutions now offer loans for business women and this loans are designed to support small ventures, startups, and growing enterprises led by women.

If you’re a woman entrepreneur looking for funding to start business and growing you are business here are the top 5 loans for business women in India that can help you launch or expand your business in 2025.

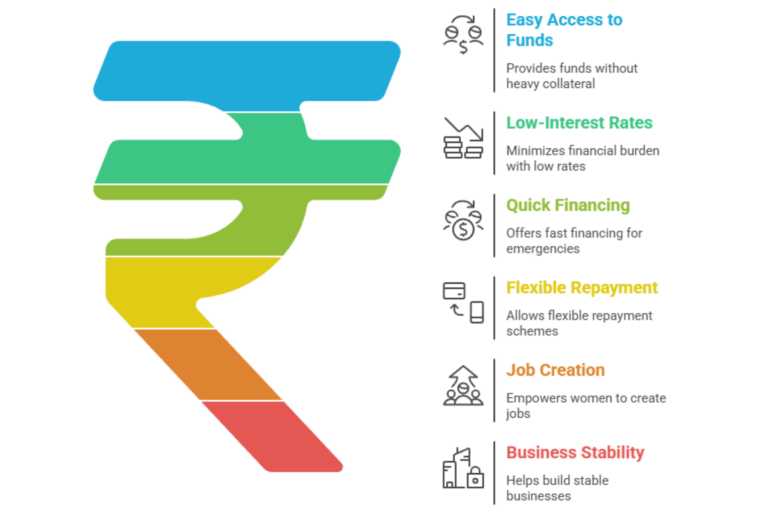

How Loans for Business Women Help Your Business?

These Loans for Business Women to provide crucial support to start, manage and expand their businesses. Here’s how they help:

Provide easy access to funds without heavy collateral requirements.

Provide low-interest rates to minimize financial load.

Enable quick financing and flexible repayment schemes for emergencies.

- Empowers women to build stable businesses and create jobs within their communities.

These loans for business women give the financial support and confidence to turn their ideas into successful businesses.

Can women entrepreneurs get business loans without collateral in India?

Yes, some of the loan schemes in India offer collateral free business loans for women. The Mudra Loan (PMMY) is one of the most popular and the loan is providing up to ₹10 lakh without requiring security.Many private lenders and NBFCs also offer loans based on business income or performance rather than assets. These options are ideal for first time entrepreneurs without property or financial backing.These loans are easier to obtain with low interest rates, less paper work and a focus toward self-employment which means that women can easily start their businesses and expand them.

List of Top 5 Loans for Business Women

1. Mudra Loan for Women (PMMY).

The Pradhan Mantri Mudra Yojana (PMMY) is one of the most available options for women. Those who are starting a small business It offers collateral free loans through banks NBFCs, and microfinance institutions.

- Collateral: Not required.

- Best for tailoring, beauty parlors, grocery shops and home-based services.

- Why it works: Government backed loan with low interest and flexible repayment.

Many banks give priority to women applicants, and the process is designed to support first-time entrepreneurs with minimal documentation.

2. Stand Up India Scheme.

This scheme encourages womens to start new businesses by offering high ticket loans backed by credit support.

Loan range: ₹10 lakh to ₹1 crore.

Collateral: Required (with guarantee cover via CGSSI).

Best for manufacturing, trading or service-based businesses.

Why it works: Every scheduled commercial bank branch is required to issue one loan to a woman entrepreneur, improving access significantly.

This is one of the best loans for business women to start a new business or expand an existing one.

3. Annapurna Scheme (Food Business Loan).

Annapurna Scheme is one of the best loans for business women who want to launch or expand their small food businesses, if you’re running a tiffin service or starting a catering company.

Loan range Up to ₹50,000.

Collateral: may be required; often needs a guarantor.

Best for Catering, packaged food and home kitchens.

Why it works: it helps cover essential expenses like equipment, delivery bikes, and raw materials.

This is one of the best loans for busines women to start a new business or expand an existing one.

4. Dena Shakti Scheme.

Originally a Dena Bank product, this scheme is now offered through Bank of Baroda and supports women entrepreneurs in select business sectors.

Loan range Up to ₹20 lakh (varies by sector).

Interest benefit: 0.25% lower interest rate for women borrowers.

Best for Retail shops, agri-business, manufacturing units, and small service centers.

Why it works: Encourages financial independence through subsidized lending and sector-specific support.

It is one of the great loans for women who already have a business and are looking to expand their operations without heavy interest burdens.

.

5. Private Business Loans for Women Entrepreneurs.

Many banks and NBFCs have created exclusive loans for women to support their growing role in India’s startup and SME ecosystem.

Loan range ₹50,000 to ₹50 lakh.

Collateral: Often not required.

Best for Women with existing business income, digital ventures, consultancy firms, or registered startups.

Why it works: Quick approval,minimal paperworkand customized offers for women.

Some lenders even offer top-up loans, flexible repayment and reduced processing fees as added benefits for Women applicants.

Conclusion

if you’re just starting your business or planning to expand your existing one, in india, there are several reliable loan options available for women entrepreneurs Use the above-mentioned best loans for business women to choose the right one for your needs.

If you’re unsure where to begin, Unik Finance is here to help. We specialize in guiding women business owners through the loan process. if it’s applying under a government scheme or choosing the best offer from a private lender.

Get in touch with Unik Finance today to explore your best options and take the next step toward growing your business.